Your Look back calculation example images are ready in this website. Look back calculation example are a topic that is being searched for and liked by netizens now. You can Download the Look back calculation example files here. Get all royalty-free photos and vectors.

If you’re searching for look back calculation example pictures information related to the look back calculation example keyword, you have come to the ideal site. Our website always gives you suggestions for refferencing the highest quality video and picture content, please kindly hunt and find more enlightening video content and graphics that match your interests.

Look Back Calculation Example. This image of the Hubble Ultra-deep Field HUDF is the ultimate visible-light view back in time. In the completion year if for each prior contract year the cumulative taxable income or loss actually reported under the contract is within 10 of the cumulative look-back income or loss. For low redshifts - lets say smaller than 01 - and by that I mean the wavelength increases by 10 percent you might get away with using Hubbles law to estimate the distance and then get the look back time by dividing by the speed of light. The light left some of the more distant.

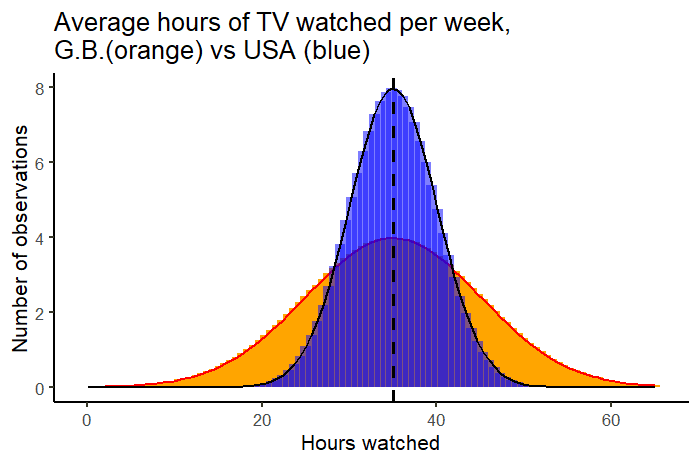

Understanding Confidence Intervals Easy Examples Formulas From scribbr.com

Understanding Confidence Intervals Easy Examples Formulas From scribbr.com

You have a 15 discount on the purchase date that is based on the lower of either the price on that date or the price at the start of the offering. Instruct the taxpayer to prepare a Form 8697 and use the closing procedure above for Situation 1 under Closing Procedures for Refunds of Look-back Interest. The look-back method is an approach for tracking employee hours and based on the average hours they work over a set period of time which is the measurement period. Your companys stock price is 10 at the start of the offering and 12 at the end of the six-month purchase period. The look-back calculation retrospectively compares the estimated revenues recognized in the prior years of the contract to the revenues that should have been recognized in those prior years based upon the final contract amounts. In this example our employee worked a total of 1596 hours resulting in an average of 133 hours per month.

Look-back method in certain de minimis cases for completed contracts.

The Form 8697 filed with the Form 1120 reflected look-back interest owed of 500000. The look-back calculation compares the percentage of gross profit that was recognized in prior years to the actual gross profit percentage once the job has been completed. There needs to be a provision that looks back to the estimate and determines whether that estimate produced taxable income in the correct amountThe look-back calculation protects both the IRS and the taxpayer from miscalculations of estimated gross profitAlthough the correct amount of income tax will be paid when the contract finishesthis allows. That is added to the interest which is. The calculation determines if the gross profit on a job was over or underreported in prior years based on job cost estimates at the time you filed your income tax return. Look back at the calculations in Example B.

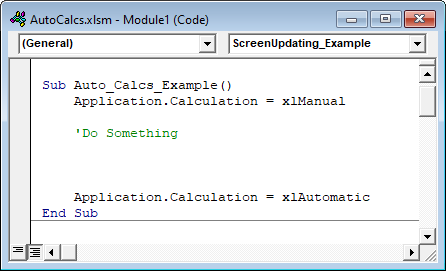

Source: automateexcel.com

Source: automateexcel.com

If you see this option on a checklist check the box. The taxpayer properly included the amount as an additional tax and deducted 500000 as interest expense. For example if the Measurement Period is six months an employee with 780 hours of service during those six months is full-time. The light left some of the more distant. Updated April 21 2017 – For Administrators and Employees The look-back method is an approach for tracking employee hours and based on the average hours they work over a set period of time called the measurement period.

Source: allaboutcircuits.com

Source: allaboutcircuits.com

If you see this option on a checklist check the box. Overview of the Look-Back Method Measurement Period Track employeeshours during the Measurement Period Full-Time 780 hrs 6 months. Tracking Employee Hours Using the Look-Back Method. For example if the Measurement Period is six months an employee with 780 hours of service during those six months is full-time. 1 MaxA3-90 always returns a positive number after 9.

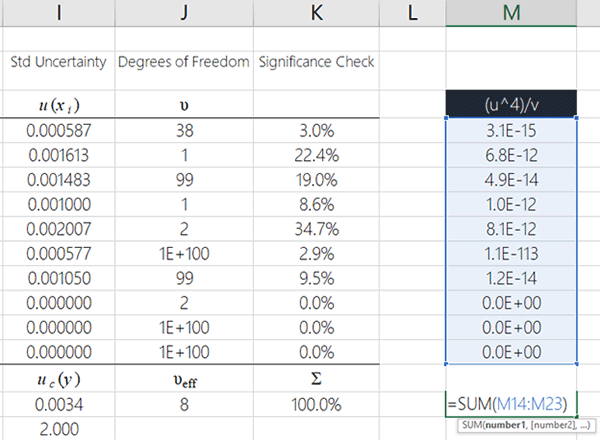

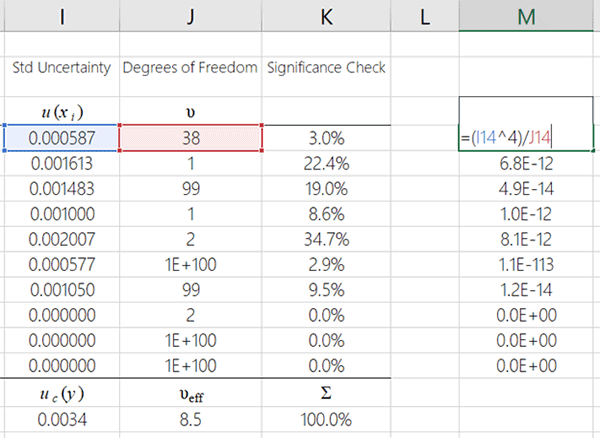

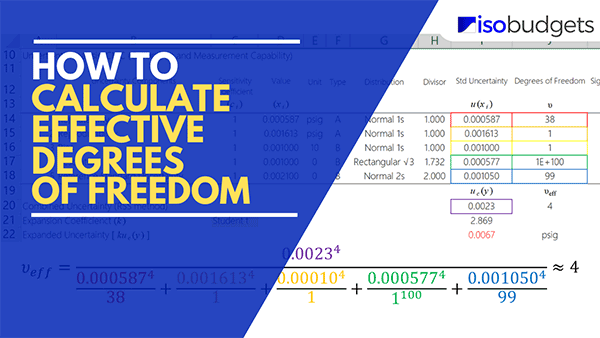

Source: isobudgets.com

Source: isobudgets.com

If the next data point is at 150 seconds for exampleit will return Max 1410 which would give the row number of the instance above itdespite it being more than 9 seconds in the past. There is interest due to the IRS in the case where you had 36k of income in the 3rd year instead of 12k in each of the 3 years. The Return on Cost shall be calculated by the EDAs municipal advisor based on the. In this example our employee worked a total of 1596 hours resulting in an average of 133 hours per month. That is added to the interest which is.

Source: thepowermba.com

Source: thepowermba.com

If the employee worked an average of 30 hours per week during the look-back period the employer must consider the employee a full-time employee during the subsequent stability period. In the completion year if for each prior contract year the cumulative taxable income or loss actually reported under the contract is within 10 of the cumulative look-back income or loss. Means upon Stabilization the amount of the TIF Note will be subject to a lookback and potential adjustment based on a target Return on Cost of 10. Her television a her garden b her childhood c her. 1 MaxA3-90 always returns a positive number after 9.

Source: investopedia.com

Source: investopedia.com

Interest due to or refunded from the IRS is then calculated based on the difference between the tax liability previously reported as. You have a 15 discount on the purchase date that is based on the lower of either the price on that date or the price at the start of the offering. Updated April 21 2017 – For Administrators and Employees The look-back method is an approach for tracking employee hours and based on the average hours they work over a set period of time called the measurement period. The look-back method is an approach for tracking employee hours and based on the average hours they work over a set period of time which is the measurement period. The taxpayer properly included the amount as an additional tax and deducted 500000 as interest expense.

Source: exceljet.net

Source: exceljet.net

The policy creates an initial measurement period that lasts for 12 months beginning on the first day of the calendar month after the employees start date or on the employees start date if and only if the employees start date occurs on the. Complete the calculations in Example 1717 in order to. Interest due to or refunded from the IRS is then calculated based on the difference between the tax liability previously reported as. The policy creates an initial measurement period that lasts for 12 months beginning on the first day of the calendar month after the employees start date or on the employees start date if and only if the employees start date occurs on the. The look-back method does not apply in the following cases if the election is made.

Source: isobudgets.com

Source: isobudgets.com

Additional filters are available in search. For a 12-month Measurement Period the threshold for full-time status is 1560 hours of service. The taxpayer properly included the amount as an additional tax and deducted 500000 as interest expense. Your companys stock price is 10 at the start of the offering and 12 at the end of the six-month purchase period. Students also viewed these Linear Algebra questions.

Source: investopedia.com

Source: investopedia.com

The policy creates an initial measurement period that lasts for 12 months beginning on the first day of the calendar month after the employees start date or on the employees start date if and only if the employees start date occurs on the. For example if the Measurement Period is six months an employee with 780 hours of service during those six months is full-time. Z entered into a contract in 1990 for a fixed price of 1000 x. The application of the look-back method by a taxpayer using the 10-percent method is illustrated by the following example. 1 MaxA3-90 always returns a positive number after 9.

Source: investopedia.com

Source: investopedia.com

Some rm services may not be available to attest clients. In your companys employee stock purchase plan. If the next data point is at 150 seconds for exampleit will return Max 1410 which would give the row number of the instance above itdespite it being more than 9 seconds in the past. Example 3 ABC Inc. Means upon Stabilization the amount of the TIF Note will be subject to a lookback and potential adjustment based on a target Return on Cost of 10.

Source: isobudgets.com

Source: isobudgets.com

Means upon Stabilization the amount of the TIF Note will be subject to a lookback and potential adjustment based on a target Return on Cost of 10. The look-back method does not apply in the following cases if the election is made. The interest is based on the tax due on the 12k from year 1 that was deferred into the 3rd year. In general the look-back measurement method allows the employer to select a look-back period of time to measure whether the employee worked an average of 30 hours per week. Instruct the taxpayer to prepare a Form 8697 and use the closing procedure above for Situation 1 under Closing Procedures for Refunds of Look-back Interest.

Source: investopedia.com

Source: investopedia.com

This image of the Hubble Ultra-deep Field HUDF is the ultimate visible-light view back in time. If the employee worked an average of 30 hours per week during the look-back period the employer must consider the employee a full-time employee during the subsequent stability period. Some rm services may not be available to attest clients. Additional filters are available in search. For example if the Measurement Period is six months an employee with 780 hours of service during those six months is full-time.

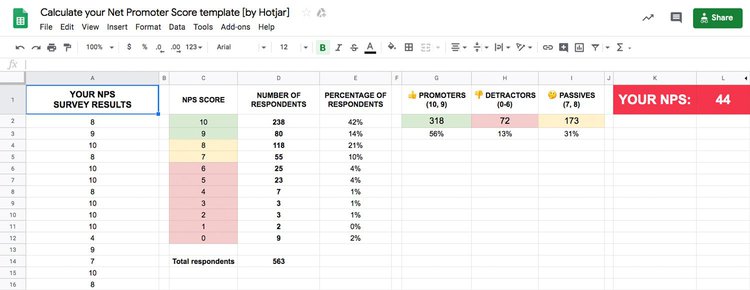

Source: hotjar.com

Source: hotjar.com

Time employee for that Measurement Period. In the completion year if for each prior contract year the cumulative taxable income or loss actually reported under the contract is within 10 of the cumulative look-back income or loss. Look back on sth When I look back on my teenage years Im amazed by the crazy and dangerous things we used to do. The look-back calculation compares the percentage of gross profit that was recognized in prior years to the actual gross profit percentage once the job has been completed. Elects to utilize the look back measurement method which it documents in a policy created by the company.

Source: personio.com

Source: personio.com

Overview of the Look-Back Method Measurement Period Track employeeshours during the Measurement Period Full-Time 780 hrs 6 months. In this example our employee worked a total of 1596 hours resulting in an average of 133 hours per month. Look back at the calculations in Example B. Some rm services may not be available to attest clients. The application of the look-back method by a taxpayer using the 10-percent method is illustrated by the following example.

Source: priceintelligently.com

Source: priceintelligently.com

There is interest due to the IRS in the case where you had 36k of income in the 3rd year instead of 12k in each of the 3 years. For very distant objects the lookback time is increased by the Hubble expansion of the Universe which is causing the space between galaxies to increase with time. Calculation of Sellers Look-Back Costs and Look-Back Payment Sample Clauses. 1 MaxA3-90 always returns a positive number after 9. Students also viewed these Linear Algebra questions.

Source: sqlshack.com

Source: sqlshack.com

Because the average hours worked over the measurement period are greater than the 130 hours per month the employee measured ACA full-time and is. Z entered into a contract in 1990 for a fixed price of 1000 x. The look-back method does not apply in the following cases if the election is made. Means upon Stabilization the amount of the TIF Note will be subject to a lookback and potential adjustment based on a target Return on Cost of 10. Look for 2019 earned income and 2021 earned income tax credit.

Source: baremetrics.com

Source: baremetrics.com

If the employee worked an average of 30 hours per week during the look-back period the employer must consider the employee a full-time employee during the subsequent stability period. The look-back calculation compares the percentage of gross profit that was recognized in prior years to the actual gross profit percentage once the job has been completed. For example if the Measurement Period is six months an employee with 780 hours of service during those six months is full-time. In the completion year if for each prior contract year the cumulative taxable income or loss actually reported under the contract is within 10 of the cumulative look-back income or loss. Example 3 ABC Inc.

Source: scribbr.com

Source: scribbr.com

Repeat the calculations in Example 1 using a cubic runout spline to interpolate the five data points. Example 3 ABC Inc. Look back at the calculations in Example B. The interest is based on the tax due on the 12k from year 1 that was deferred into the 3rd year. Updated April 21 2017 – For Administrators and Employees The look-back method is an approach for tracking employee hours and based on the average hours they work over a set period of time called the measurement period.

Source: hotjar.com

Source: hotjar.com

In the completion year if for each prior contract year the cumulative taxable income or loss actually reported under the contract is within 10 of the cumulative look-back income or loss. The interest is based on the tax due on the 12k from year 1 that was deferred into the 3rd year. A less common way you may be asked about the lookback is Your name wishes to elect to use their 2019 earned income to figure their 2021 earned income credit andor child tax credit. Example 3 ABC Inc. Look back on sth Terry tries not to look back on his time in the war.

This site is an open community for users to do submittion their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also save this blog page with the title look back calculation example by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.