Your What do underwriters look for loan approval images are ready. What do underwriters look for loan approval are a topic that is being searched for and liked by netizens now. You can Download the What do underwriters look for loan approval files here. Get all free photos.

If you’re looking for what do underwriters look for loan approval images information connected with to the what do underwriters look for loan approval topic, you have pay a visit to the ideal blog. Our website frequently provides you with suggestions for seeing the maximum quality video and picture content, please kindly hunt and find more informative video articles and images that fit your interests.

What Do Underwriters Look For Loan Approval. Once you have finished turning in all of your paperwork the underwriters will look at your credit report income and current debt obligations to determine whether you have the means to. Whats an underwriter do. In this case value refers to your collateral. In considering your application they look at a variety of factors including your credit history income and any outstanding debtsThis important step in the process focuses on the three Cs of underwriting credit capacity and collateral.

7 Step Mortgage Approval Process Canada From richardsmortgagegroup.ca

7 Step Mortgage Approval Process Canada From richardsmortgagegroup.ca

After youve gathered all of your financial documents and applied for a small business loan the fate of your financing lies in the hands of an underwriter. Its paramount to submit a clean file to boost your chances or approval. However most lenders will review the. Underwriting simply means that your lender verifies your income assets debt and property details in order to issue final approval for your loan. In this case value refers to your collateral. Underwriters often consider this if youre applying for a loan without collateral.

They want to make sure you have enough in assets usually equipment or property to cover the cost of the loan in the event that you default.

Lets discuss what underwriters look for in the loan approval process. The underwriter will wait for conditions listed on the conditional loan approval. When your future home undergoes an appraisal a mortgage underwriter takes a look at your finances and assesses how much of a risk a lender will take on if they decide to give you a loan. So in essence its really a conditional loan approval. If a buyer has outgoing bills of 2500 and makes 3000 monthly income then the underwriter will not approve a loan with a 600 car payment. High debt ratios trigger secondary audits of credit files andor a lender interview prior to a decision.

Source: quickenloans.com

Source: quickenloans.com

Theyll also verify your income and employment details and check out your DTI. If a buyer has outgoing bills of 2500 and makes 3000 monthly income then the underwriter will not approve a loan with a 600 car payment. In this case value refers to your collateral. Underwriters review all of your submitted financial documents to ensure that you have the ability and willingness to repay your mortgage in accordance with the Ability to Repay ABR rule. So in essence its really a conditional loan approval.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

An underwriter is a financial expert who takes a look at your finances and assesses how much risk a lender will take on if they decide to give you a loan. Once accepted the mortgage underwriter will. 34 Related Question Answers Found What do underwriters look for on bank statements. The underwriter helps the mortgage lender decide whether or not youll get approval on your loan and will work with you to make sure that you submit all your paperwork. The underwriter will wait for conditions listed on the conditional loan approval.

Source: creditdonkey.com

Source: creditdonkey.com

After youve gathered all of your financial documents and applied for a small business loan the fate of your financing lies in the hands of an underwriter. Submit the additional documents the same day of the request if possible. More specifically underwriters evaluate your credit history assets the size of the loan you request and how well they anticipate that you can pay back your loan. If the loan is approved youll receive a list of conditions which must be met before you receive your loan documents. Besides your bank statements lenders will also try to verify your income assets and identification through things like paystubs W-2 forms tax returns and photo identification so it helps to have this documentation on hand.

Source: veteransunited.com

Source: veteransunited.com

What do underwriters look for before closing. So in essence its really a conditional loan approval. Once accepted the mortgage underwriter will. Getting your loan from conditional approval to final approval could take about two weeks but theres no guarantee about this timeframe. What you will be asked to submit and what the lenders will examine can vary according to the institution.

Source: guildmortgage.com

Source: guildmortgage.com

The business loan underwriting process is the step between applying for a loan and receiving your money. When your future home undergoes an appraisal a mortgage underwriter takes a look at your finances and assesses how much of a risk a lender will take on if they decide to give you a loan. The underwriter will wait for conditions listed on the conditional loan approval. What else do underwriters look for in loan approval. 34 Related Question Answers Found What do underwriters look for on bank statements.

Source: homebuyinginstitute.com

Source: homebuyinginstitute.com

Lets discuss what underwriters look for in the loan approval process. Underwriters review all of your submitted financial documents to ensure that you have the ability and willingness to repay your mortgage in accordance with the Ability to Repay ABR rule. If a buyer has outgoing bills of 2500 and makes 3000 monthly income then the underwriter will not approve a loan with a 600 car payment. Most of the time underwriters look for around two years of steady income. How far back do Underwriters look.

Source: forbes.com

Source: forbes.com

What you will be asked to submit and what the lenders will examine can vary according to the institution. An underwriter will take an in-depth look at your credit and financial background in order to determine if youre eligible. More specifically underwriters evaluate your credit history assets the size of the loan you request and how well they anticipate that you can pay back your loan. How far back do Underwriters look. What do loan underwriters look at to approve.

Source: inflooens.com

Source: inflooens.com

Once you have finished turning in all of your paperwork the underwriters will look at your credit report income and current debt obligations to determine whether you have the means to. Whats next after underwriting approval. Here are some of the things the FHA underwriter will look for during this process. Underwriters review all of your submitted financial documents to ensure that you have the ability and willingness to repay your mortgage in accordance with the Ability to Repay ABR rule. A mortgage underwriter may review your personal information including your credit history credit score annual income and overall savings to determine your eligibility for mortgage loan approval.

Source: efinancemanagement.com

Source: efinancemanagement.com

Submit the additional documents the same day of the request if possible. The underwriter will wait for conditions listed on the conditional loan approval. High debt ratios trigger secondary audits of credit files andor a lender interview prior to a decision. More specifically underwriters evaluate your credit history assets the size of the loan you request and how well they anticipate that you can pay back your loan. Enough cash saved up for the down payment and closing costs The source of.

Source: mojomortgages.com

Source: mojomortgages.com

34 Related Question Answers Found What do underwriters look for on bank statements. 34 Related Question Answers Found What do underwriters look for on bank statements. Lenders will look into your loan application and ask you to provide a number of documents to help them determine whether to approve your business loan. However most lenders will review the. How far back do Underwriters look.

Source: thetruthaboutmortgage.com

Source: thetruthaboutmortgage.com

What are underwriters looking at when they are approving a mortgage. What you will be asked to submit and what the lenders will examine can vary according to the institution. The underwriter the person who evaluates and approves mortgages will look for four key things on your bank statements. They will also look at your credit report to help determine if youll be able to pay the loan back or if you have a history of late payments. Lenders typically look for a ratio of more than 10.

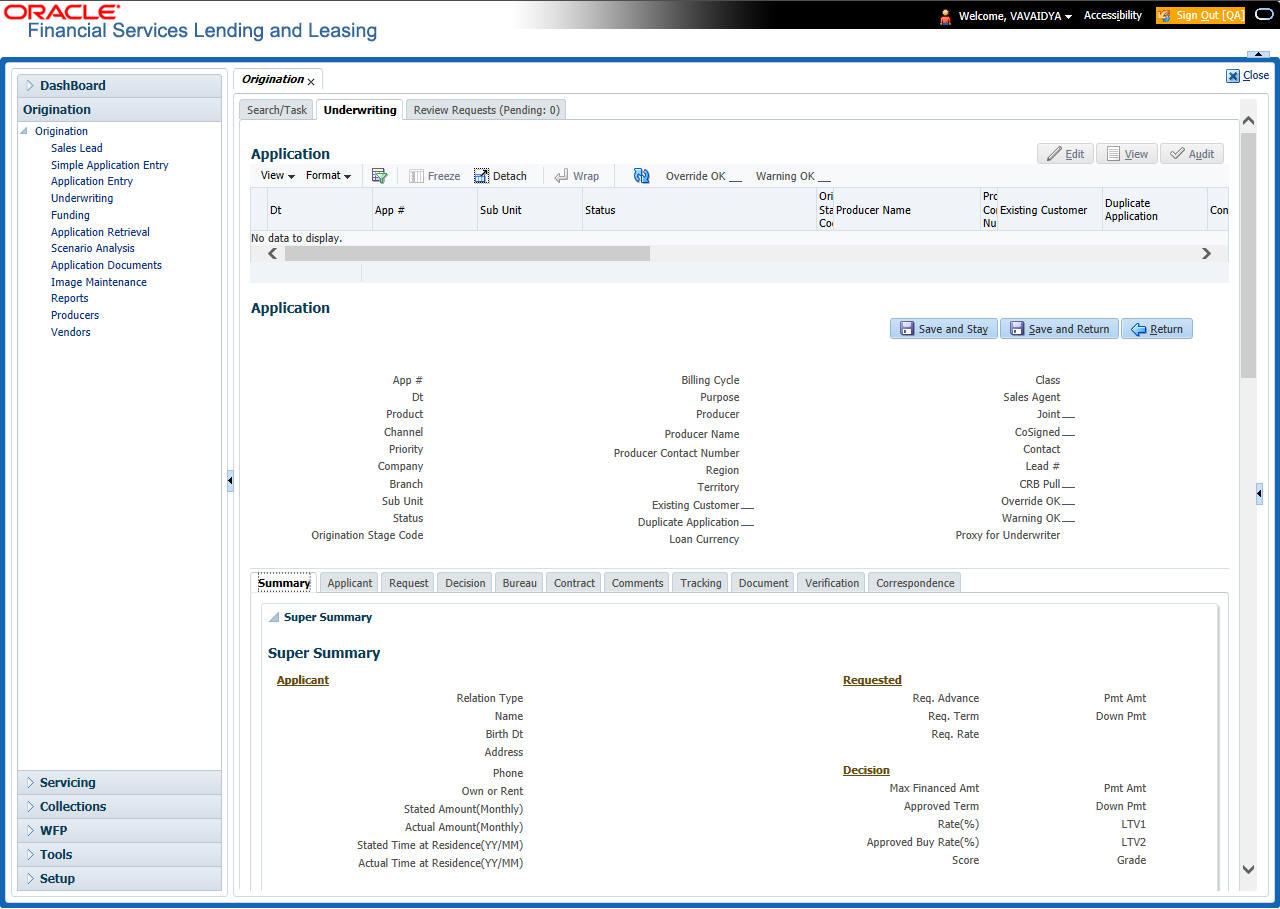

Source: docs.oracle.com

Source: docs.oracle.com

Its paramount to submit a clean file to boost your chances or approval. The borrowers credit scores and possibly credit reports Debt-to-income ratio or DTI Bank statements that show current verified assets Pay stubs that show year-to-date earnings and other employment documents. In considering your application they look at a variety of factors including your credit history income and any outstanding debtsThis important step in the process focuses on the three Cs of underwriting credit capacity and collateral. Underwriting simply means that your lender verifies your income assets debt and property details in order to issue final approval for your loan. In other words loan underwriting is crucial to securing the funds your business needs.

Source: gustancho.com

Source: gustancho.com

For a loan the underwriter is going to be looking for things like pay stubs to verify income and monthly expenses to understand how much free cash you have available. High debt ratios trigger secondary audits of credit files andor a lender interview prior to a decision. What you will be asked to submit and what the lenders will examine can vary according to the institution. More specifically underwriters evaluate your credit history assets the size of the loan you request and how well they anticipate that you can pay back your loan. Lenders typically look for a ratio of more than 10.

Source: fairwaymortgagecarolinas.com

Source: fairwaymortgagecarolinas.com

So in essence its really a conditional loan approval. Once borrowers provide all conditions the underwriter will carefully review the conditions. An underwriter will take an in-depth look at your credit and financial background in order to determine if youre eligible. Lets discuss what underwriters look for in the loan approval process. The Information About Your Small Business Underwriters Need.

In this case value refers to your collateral. Theyll also evaluate the property you. Submit the additional documents the same day of the request if possible. What Is Conditional Mortgage Loan Approval. Theyll also verify your income and employment details and check out your DTI.

Source: factorywarrantylist.com

Source: factorywarrantylist.com

So in essence its really a conditional loan approval. A mortgage underwriter may review your personal information including your credit history credit score annual income and overall savings to determine your eligibility for mortgage loan approval. Whats next after underwriting approval. Through underwriting the bank credit union or mortgage lender assesses the probability of whether youre able to pay back the home loan before approving or denying your mortgage application. So in essence its really a conditional loan approval.

Source: getloans.com

Source: getloans.com

What do underwriters look for to approve a loan. The business loan underwriting process is the step between applying for a loan and receiving your money. 34 Related Question Answers Found What do underwriters look for on bank statements. Once accepted the mortgage underwriter will. The underwriter the person who evaluates and approves mortgages will look for four key things on your bank statements.

Source: richardsmortgagegroup.ca

Source: richardsmortgagegroup.ca

Whats an underwriter do. Theyll probably ask to see your previous tax returns or other records of income. What do underwriters look for before closing. In other words loan underwriting is crucial to securing the funds your business needs. What do underwriters look for to approve a loan.

This site is an open community for users to submit their favorite wallpapers on the internet, all images or pictures in this website are for personal wallpaper use only, it is stricly prohibited to use this wallpaper for commercial purposes, if you are the author and find this image is shared without your permission, please kindly raise a DMCA report to Us.

If you find this site adventageous, please support us by sharing this posts to your favorite social media accounts like Facebook, Instagram and so on or you can also bookmark this blog page with the title what do underwriters look for loan approval by using Ctrl + D for devices a laptop with a Windows operating system or Command + D for laptops with an Apple operating system. If you use a smartphone, you can also use the drawer menu of the browser you are using. Whether it’s a Windows, Mac, iOS or Android operating system, you will still be able to bookmark this website.